Free market is dead - long live the free market

(Don’t pull the Devil by the tail)

The current financial crisis has provoked a multitude of problems and fierce discussions over the reasons, consequences and the prospects of the attempted bail-outs, reaching even the fundamental values of capitalism - the free market and democracy. After all, Government regulation in the form of a temporary cash bail-out via partial or total nationalization is an unprecedented intervention. Whether associated with “socialism” or not, the fact is that someone else in a bureaucratic entity, possibly an ordinary non-elected poor employee, is going to gain control over a private person’s assets, money and actions. It also means that taxpayers and future generations will bear the burden of someone else’s debts.

Is it not an irony of history that those who proclaimed collective state ownership the worst evil and worshipped privatization now plead for nationalization and turn to the state to bail them out of bankruptcy? What does this portend in the long run – an end to privatization or a complex reform of the free market system, or its collapse, especially when the inevitable international consequences are taken into account?

One thing is already clear: economic changes of such a gravity cannot but lead to very deep and far-reaching political and social effects transforming our societies and the world at large.

Apologists for capitalism all over the world who are aware of these long-term prospects are fearful of the return of Marx's specter.

Z. Brzezinski sees this specter in US self-complacency: “We had a strong alternative in the face of the Soviet block which stimulated us to move forward, to be an example of humanism for the whole world and to achieve results that were approved and envied by the oppressed all over the world. Now this has disappeared, we have relaxed and fallen back into our own self-complacency that we had achieved a victory over communism.”

George Soros – one of the richest self-made men in the world - sees the specter in the form of the anarchy of finance capital. A long time ago he claimed that the global finance system was out of control and needed to be regulated. His calls for a return to an "international regulator" like Bretton Woods, or some body attached to the IMF, have been repeatedly disregarded. He feared that the casino of finance capital would bring an end to the new world order and provoke a return to anarchy and social revolution. Have his warnings been heeded? Not until recently.

Anthony Giddens – another prominent apologist for capitalism - sees the specter in the rise of left or right fundamentalist ideologies and social upheavals.

A famous New York humor columnist ridiculed the harsh language on workers, class struggle and revolution as the midwife of history of Marxists as being out of zinc with today’s realities.

“I know you want to help the workers, guys, but with language like that, how many actual workers are going to read this thing? And, FYI, we don't like to be called "workers" or "laborers" or even "employees" - we prefer to be called "consumers." As consumers, we are not "forced" to do anything. As consumers, we are empowered to make important daily decisions about whether we will consume the GAP or Old Navy; Iraq or Venezuela; salmonella or E. coli; unaffordable health insurance or no health insurance.”

However, both the professional and less serious apologists for capitalism have hopes or plans to avoid a global collapse like the Great Depression during the 30’s of the 20th Century leading to the rise of fascism and the Second World War. In fact all of us hope to avoid such a global catastrophe.

However, the current financial crisis has brought us down to earth and re-opened the gate for a some open rethinking of what is going on in today’s world, for discussions of capitalism and democracy as a system, for criticisms against it, for ideas and proposals of alternatives, and, of course, for practical actions.

Some critically minded authors versed in the Marxist tradition have already sarcastically noted that apologists for capitalism have posed the current problem in terms long time familiar to them: the contradiction between dead and living labor and the rise of the dead reclaimed by the living.

Others have remarked that any analogy with 19 Century conditions and social recipes based on those conditions are ridiculous and not the best approach to today’s problems.

There is one thing in common though with the above vastly different view-points. This is the big question: is there a way out for capitalism from the dead-end created by itself?

The leaders of USA and Europe have pinned their hopes and actions on a number of attempts to bail-out the banking sector. More or less this strategy is clear to all. The keyword is nationalization. Its implementation has already started. But is it going to work? Is it possible to implement solutions of a large array of particular problems related to the financial crisis or underlying it like rising unemployment, global competition for scarce resources, product quality, environment deterioration, supra-national regulation and so on without a radical change in the basic institutions of society and the present world order?

The most obvious thing to do is to look back into the recent past and see how similar policies have worked. Bail-outs in the form of nationalization are not new. There are plenty of examples of successful and unsuccessful bail-outs, both inside and outside the financial sector. The BBC has already presented a number of cases, namely:

- the successful bail out by the US Government of the airline industry after September 11th;

- the unsuccessful bail-out of Leyland Co. by the British Government via a cash injection in 1975;

- the nationalization of Rolls-Royce in 1971.

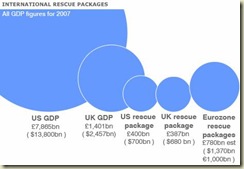

The diagram below borrowed from BBC’s website shows in figures the current banking sector bail-out:

Source: BBC News, 6 October 2008

Another possible check of the volatile prospects of this endeavor is to monitor the performance

of the stock markets. Fortunately enough, there is abundant information on the immediate reaction and downturn trend of investors whose behavior is often compared to that of a rein-deer sensing an upcoming storm. Take a look at the diagrams below of a few of the major indexes:

Stock markets: FTSE 100 index

Dow Jones:

Based on these facts and volatile data, it is too early to predict the final outcome of the corrective measures undertaken at the moment. We still have to see the positions of the new large international players. Therefore, at this stage we can engage primarily in futuristic speculations and historic analogies.

A few words on the skeptically minded. They have their arguments based also on hard facts.

The first argument is that the current financial crisis cannot be solved by the USA and the EU alone – a fact acknowledged by political leaders and reflected in the decision to convene a global meeting with the participation of new economic powers like China, Russia, India, Brazil, Mexico, etc.

The second argument is based on the convergence of a number of other crises beyond human control - the global energy crisis (depletion of crude oil resources and end of hydro-carbon era), the climate changes, the food and drinking water crises – all of which are pre-determined in the final analysis by natural factors.

The third argument is proverbially simple but no less convincing: “you cannot cook an omelet without breaking the egg” which is obviously an ideological cliche.

For this reason no scenarios for the development of the current financial-economic crisis can be excluded, especially the worst one – a global depression, social upheavals or even a series of regional wars (for energy resources).

Whatever the outcome of the pending international negotiations on the solution of the current global financial crisis, there is still another important political question that cannot be avoided: Should the ruling classes be trembling at the prospect of a social upheaval?

Obviously, the specter of social revolution is a far-fetched and unpopular idea today, especially having in mind the notion of previous “classic revolutions” like the French or Russian ones.

However, violence has many faces – for instance terrorism, and it might become a part of a worst case scenario that should not be underestimated.

As a minimum this prospect reminds us that classes, class struggle and revolutions have taken place and are facts of our history. Matter of fact speaking, they were not invented by K. Marx but by A. Smith – the father of political economy. Marx only deepened the study of these facts and commented on history: “History likes to repeat itself – the first time as a tragedy, after that as a farce”.

David Singer wrote an article “Dancing on the Grave of Revolution: 1789 and All That” that was published by the American magazine The Nation back in 1989. I am tempted to quote, in conclusion, a thought provoking piece from it:

“It is our duty, when the occasion arises, to remind them that revolutions are not just the handiwork of active minorities but the combined result of accumulated discontent and the inability of a system to offer solutions. To remind them, too, borrowing the words of Bertolt Brecht, about the violence not just of the current but of "the riverbanks that squeeze the current between them." Yet in the present Western context, the danger is not remotely of shortcuts or premature action. As higher productivity in the West produces great unemployment, revealing the contrast between our technological genius and the absurdity of our social and political organization, the image that springs to mind is not one of premature birth but of the monsters that result from an overextended, unending pregnancy.

"Pregnancy" leads to "midwife," which opens up a potentially dangerous metaphor: Marx's reference to revolutionary violence as the midwife of history has sometimes been taken too literally, reducing the historical process to its most spectacular outbursts. In practice, 1789 and 1917 were very different in nature. Whereas the French bourgeoisie gained its ascendancy within the feudal order, the Russian proletariat did nothing of the sort. Yet can one envisage a socialist revolution that would gain power at all levels before it seized power at the top-that is to say, winning cultural hegemony in the Gramscian sense as part of its conquest of power?

In any case, the historians who dismiss revolution as the curse of the Third World or merely a historical feature are not maintaining that the next social upheaval will inevitably be different from the storming of the Bastille or the seizure of the Winter Palace. They are really arguing that there will be no such upheaval at all. Clearly they are too clever, and too keen on their profession, to proclaim openly the end of history. Yet like all faithful servants of an established order, they treat that order as something filled in perpetuity. By denying its class nature, by dismissing the possibility of radically altering property and other social relations, they allow for quantitative but not qualitative change. Precluding an alternative, they limit their own vision, and that of their readers, to the capitalist horizon.

Europe's deep freeze may be drawing to an end… Who knows when a new climate will take hold in Paris, London or Berlin? ….If they stand by the ornate column that now graces the vast square where the symbolic prison fortress of the Bastille once stood and listen carefully, they may hear the rising echo of Rosa Luxemburg's parting words: "You stupid lackeys, your order is built on sand. Tomorrow the Revolution will raise its head again and proclaim to your sorrow amid a brass of trumpets: I was, I am, I shall always be...."

Author:

Petar Mitov

http://infopreneur.dum-spiro-spero.info

No comments:

Post a Comment